Demand for AI servers is driving up Dell revenues, but storage is the poor relation, waiting for the unstructured data surge the evangelists say is coming.

Vice-chairman and COO Jeff Clarke stated: “We achieved first-quarter record servers and networking revenue of $6.3 billion, and we’re experiencing unprecedented demand for our AI-optimized servers. We generated $12.1 billion in AI orders this quarter alone, surpassing the entirety of shipments in all of FY 25 and leaving us with $14.4 billion in backlog.”

The $23.4 billion of revenue in Dell’s first fiscal 2026 quarter, ended May 2, was 5.4 percent more than last year but sequentially down for the third consecutive quarter. There was a profit (GAAP net income) of $965 million, 3 percent less than a year ago.

Quarterly financial summary

- Gross margin: 21.1 percent vs 21.8 percent a year ago

- Operating cash flow: A record $2.8 billion vs $1 billion last year

- Free cash flow: $2.23 billion vs $457 million a year ago

- Cash, cash equivalents, and restricted cash: $7.85 billion vs $5.96 billion a year ago

- Diluted EPS: $1.37 flat year-over-year

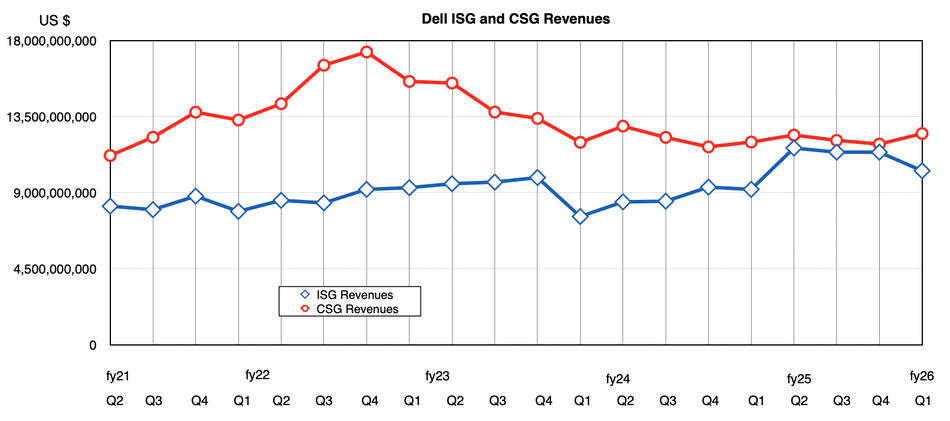

The two main business segments, the Infrastructure Solutions Group (ISG – servers plus networking and storage) and the Client Solutions Group (CSG – PCs, laptops), fared differently with ISG revenues rising 12 percent year-on-year to $10.3 billion while CSG revenues of $12.5 billion only rose 5 percent year-over-year. However, sequentially, ISG revenues have declined or been flat for three consecutive quarters while CSG revenues have risen after two declining quarters.

Commercial CSG sales rose 9 percent to $11 billion but consumer sales fell substantially by 19 percent to $1.46 billion. Dell said commercial PC demand grew for the fifth straight quarter. Overall, PC and laptop sales are picking up while ISG’s total sales of servers, networking, and storage are still on their way down from a peak in the second fiscal 2025 quarter.

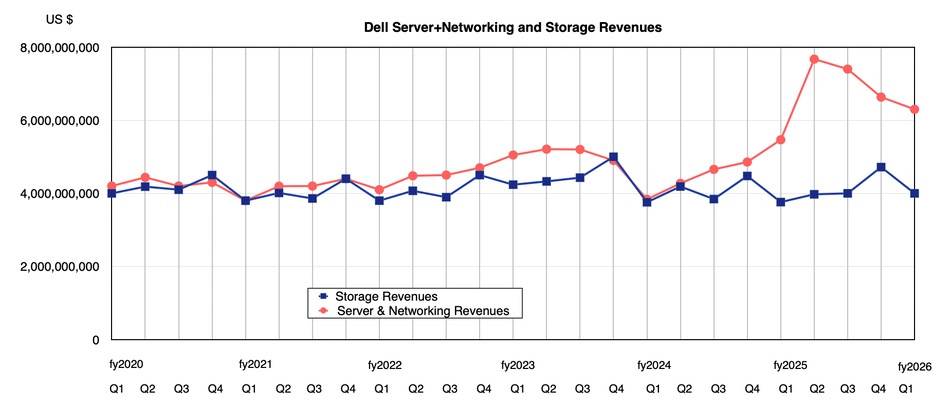

A look at the revenue trends for servers plus networking and storage inside ISG shows this as well:

Storage revenue in the latest quarter was $4 billion, 6 percent higher year-over-year, while servers and networking registered $6.3 billion in sales, which Dell says is a record for any first quarter, but it’s been sequentially down now for three quarters in a row. Storage, however, saw its third consecutive year-over-year revenue growth quarter.

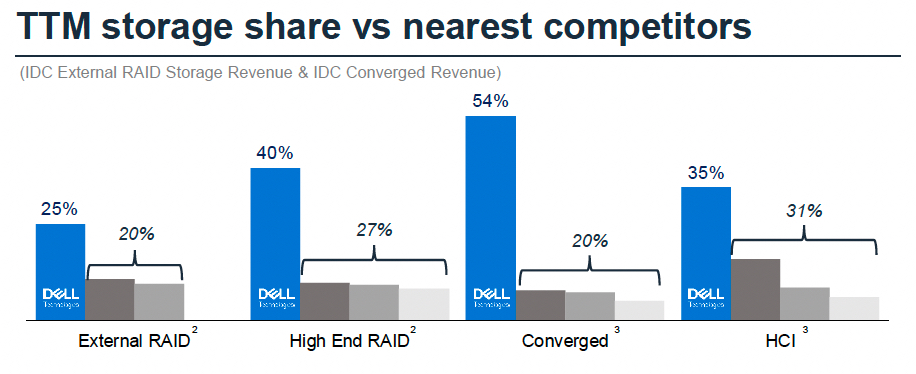

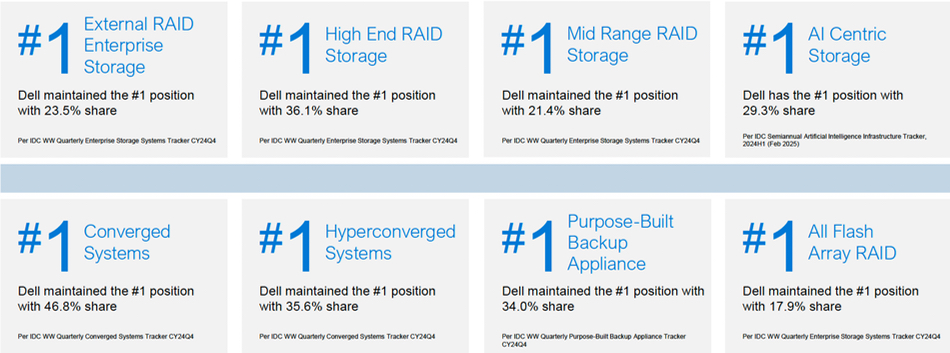

Demand for the PowerStore product was up double digits and growing for the fifth consecutive quarter. Data protection was also strong. The company maintained its leading storage market share position in the external RAID, high-end RAID, converged and HCI storage market sectors, according to IDC:

Compared to the surging AI server demand, there is, as yet, no comparable uplift in AI-related storage demand. In prepared remarks, Clarke said Dell’s areas of focus are using its own IP in the mid-range, software-defined, unstructured storage and data protection markets. These are the faster-growing, higher-margin segments.

He is seeing more customers move to disaggregated storage, saying: “We are gaining traction in data protection, with demand up double digits in both our next-generation target appliance as well as our software.”

Next quarter’s servers and networking revenue will be a tough comparison. Unless Dell sells north of $7.7 billion in servers and networking, a 22.2 percent rise or greater, it will report a year-over-year revenue decline there.

Dell expects ISG to grow significantly next quarter, driven by approximately $7 billion of AI server shipments, and CSG to grow low-to-mid-single digits. For the full year, ISG is expected to grow in the high teens, driven by $15 billion-plus AI server shipments with CSG growing still in the low-to-mid-single digits.

CFO Yvonne McGill said: “We are expecting sub-seasonal performance in traditional server and storage, our larger profit pools that provide scale, as customers evaluate their IT spend for the year, given the dynamic macro environment. Given that backdrop, we expect Q2 revenue to be between $28.5 billion and $29.5 billion, up 16 percent at the midpoint of $29 billion.

The full fiscal 2026 revenue guidance is $102 billion ± $2 billion and an 8 percent increase year-over-year at the midpoint. McGill said: “We expect ISG to grow high-teens, driven by over $15 billion in AI server shipments and continued growth in traditional server and storage. And we expect CSG to grow low-to-mid-single digits. We expect the combined ISG and CSG to grow 10 percent at the midpoint. Given what we expect for the first half, the full-year guide reflects slightly lower profitability expectations within CSG, traditional server, and storage.”

Clarke was asked about AI demand uplifting storage in the earnings call, and said: “We think the opportunity to attach storage, particularly as the data structure needs more object storage and our assets in the unstructured space, [means] we have a differentiated advantage … So we remain optimistic. We have work to do. I would not be truthful if I said we were satisfied. We are not satisfied with the attach, to date. I think that there’s all upside and opportunity.”

“Our sales team is focused on that. And we continue to find opportunities to differentiate our portfolio, look at some of the subsystems in our performance and the attributes that it brings to what’s being done in these modern workloads. And we’re very optimistic about that. … as these modern workloads evolve, it’s clear that the disaggregated storage architecture is the path to the future. I think we have the best portfolio in that. And we’ll continue to focus on that with our customers.”

He added that he is “very optimistic about the storage opportunities in Enterprise … We are building high-performance file systems and storage systems in this disaggregated storage world, where it is really new to a flexible, agile, high-performance storage system, to meet the needs of these AI workloads.” No upsurge timing prediction, though.

Comment

DDN, VAST Data, and WEKA are probably the most prominent storage suppliers to the AI market. Collectively, they probably have a larger installed AI storage base than any other supplier, with VAST possibly leader in terms of exabytes installed. Until a research firm like IDC or Gartner assesses the AI storage market, we won’t know for sure.

Our conjecture is that, as the AI market grows its inferencing side, general IT infrastructure suppliers like Dell, HPE, and Lenovo, and storage infrastructure suppliers like NetApp and Pure will be hoping their installed base chooses their kit and not the apparently more AI training market-proven DDN, VAST, and WEKA gear.

Dell says it has more than 3,000 AI Factory customers. If and when they need AI data storage, it’s possible that many, if not most of them, will be buying Dell storage.