Jamie Lerner, the chairman, CEO, and president of tape and storage systems vendor Quantum, has resigned and been replaced by part-time board director Hugues Meyrath.

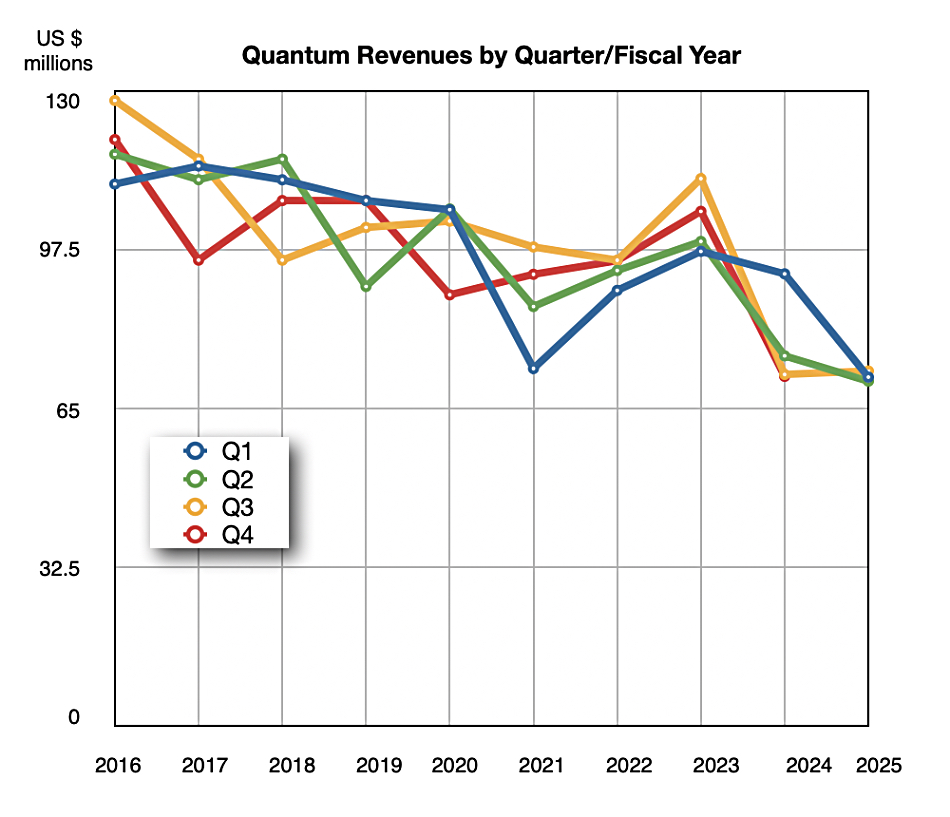

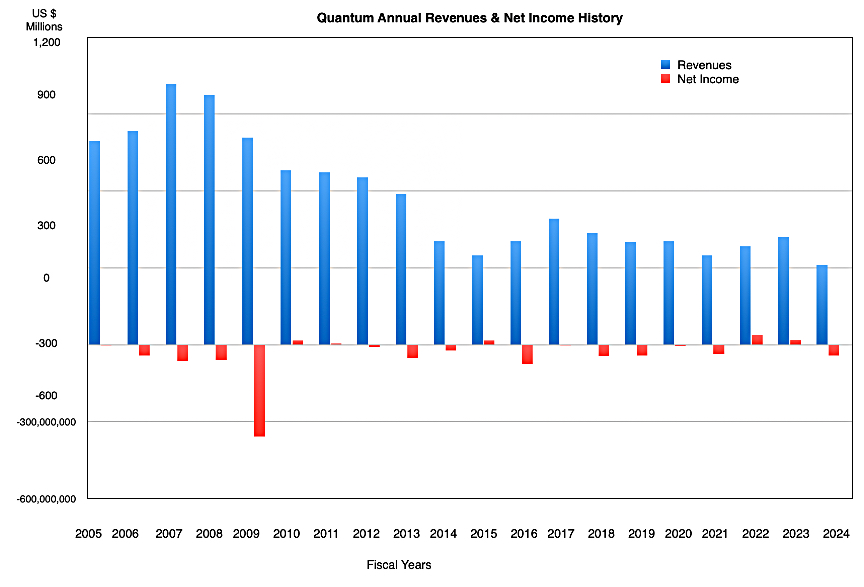

Beleaguered Quantum took a big hit when a strategy based on selling tape libraries to hyperscalers failed when the hyperscalers stopped buying them in 2024 and revenues took a dive. Its other product lines are relatively low-growth or flat and the new Myriad operating system is still far too early in its development to generate revenue. In February it reported a 1 percent rise in revenue to $72.6 million but a $71.4 million net loss in its third fiscal quarter of 2025. The loss was due to a non-cash adjustment of $61.6 million to the fair market value of warrant liabilities. Quantum reported $20.6 million in cash, cash equivalents, and restricted cash, compared to $24.5 million a year ago. Net debt was $133 million.

A statement from Meyrath said: “I am extremely excited to continue my journey with Quantum, now as CEO. I deeply appreciate the value and direction of the company’s technology, products, and potential, and look forward to working more closely with the Quantum team to unlock growth opportunities.”

An industry source tells us that a third party bought up a significant portion of its debt. We understand that Dialectic Capital Management acquired Quantum’s $51 million outstanding term debt from Blue Torch Capital in April. Dialectic co-founder and managing partner John Fichthorn rejoined Quantum’s board of directors in the same month. Quantum CFO Ken Gianella resigned and was replaced by Lewis Moorhead, promoted from chief accounting officer.

Fichthorn said in a statement: “Dialectic was founded for select investment opportunities similar to Quantum, where providing capital to solve balance sheet constraints can unlock growth. It is clear to us that Quantum has fully revamped their portfolio to address every stage of the data lifecycle and meet the demands of today’s AI era. Providing further financial freedom enables the Company to accelerate their efforts to bring this technology to a broader set of customers.”

Chris Neumeyer, an EVP and portfolio manager at Pacific Investment Management Company LLC (PIMCO), an affiliate of Quantum’s other term lender, was appointed in a non-voting observer role on the Quantum board. Neumeyer had previously served as a board member for over two years.

Lerner joined as CEO in 2018 after Quantum encountered accounting problems that led to a reverse stock split but then faced his own accounting and stock price crisis in 2024, at which point he executed a second reverse stock split. Lerner came from being COO at hyperconverged video surveillance system supplier Pivot3, which subsequently crashed with Quantum buying its assets in July 2021.

Meyrath said: “I would like to thank Jamie for his many contributions to Quantum’s history and future. He navigated multiple challenges that many CEOs never see at all, let alone in combination. Without Jamie’s leadership, we would not have the same opportunity ahead of us.”

The company named current lead independent director Donald Jaworski as its new chairman of the board. Jaworski said: “Appointing a new CEO provided a good opportunity to strengthen the company’s corporate governance practices by separating the roles of CEO and board chair. I believe Quantum is well positioned to serve the evolving needs of today’s AI-driven organizations and expect that Hugues will use his new position to drive further progress toward achieving the Company’s growth initiatives.”

Quantum provided an update on its efforts to transform its capital structure, saying it has raised approximately $60 million to date from its previously announced standby equity purchase agreement. It said it continues to make progress with its lenders to restructure its remaining outstanding debt to better position the company for future success.

Comment

Quantum has a somewhat sprawling product portfolio, including StorNext data management software, ActiveScale object storage, CatDV media asset management, DXi deduplicating backup targets, Scalar tape libraries, network video recorders, a unified surveillance platform, and the Myriad all-flash object and file storage software. B&F would not be surprised if parts of this portfolio were sold off.