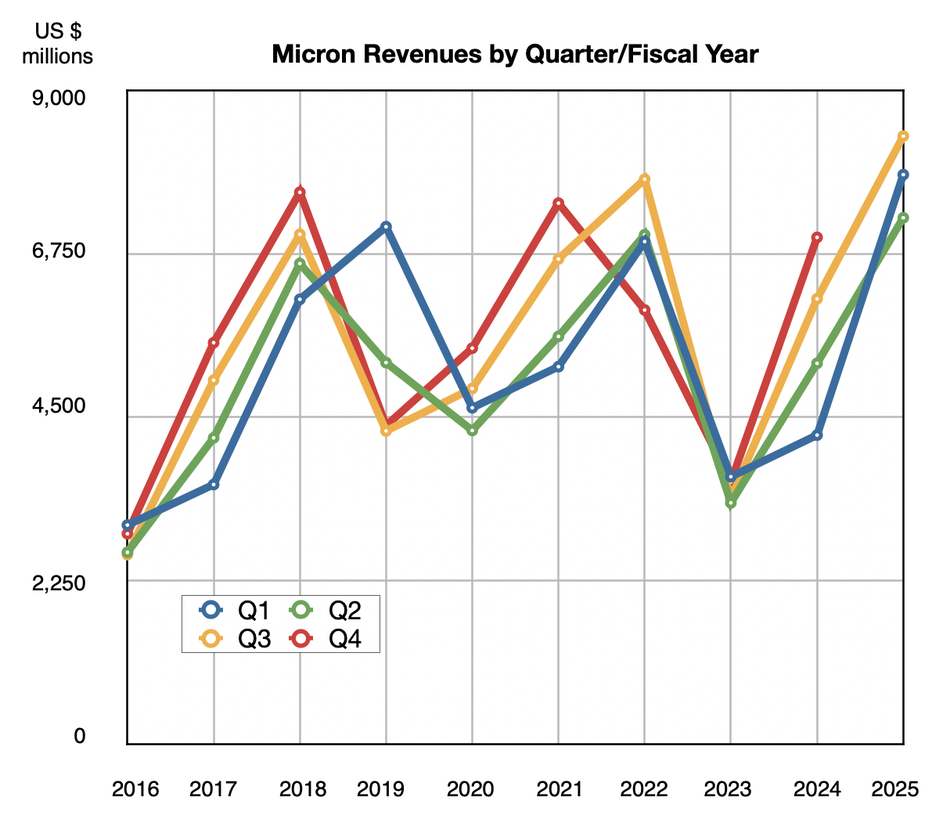

Micron reported record revenue in its third fiscal 2025 quarter as DRAM sales rocketed, with 50 percent sequential growth in HBM.

Revenues of $9.3 billion were up 37 percent year-over-year with GAAP profits of $1.9 billion, up 467.8 percent on last year. Datacenter revenue more than doubled year-over-year to a new high, and consumer-oriented markets had strong sequential growth. It is currently the only supplier producing LP DRAM at volume for the datacenter market. And for the first time ever, Micron has become the number two brand by share in datacenter SSDs, according to third-party data.

Micron chairman, president, and CEO Sanjay Mehrotra stated: “Micron delivered record revenue in fiscal Q3, driven by all-time-high DRAM revenue including nearly 50 percent sequential growth in HBM revenue … We are on track to deliver record revenue with solid profitability and free cash flow in fiscal 2025, while we make disciplined investments to build on our technology leadership and manufacturing excellence to satisfy growing AI-driven memory demand.”

DRAM revenues were $7.1 billion, up 51 percent year-over-year, while NAND revenues rose a modest 4 percent to $2.2 billion. AI training demands HBM now, while AI inferencing may, could, or should demand more SSD capacity over the next four to eight quarters.

Financial summary

- Gross margin: 37.7 vs 26.9 percent a year ago

- Operating cash flow: $4.61 billion vs $2.48 billion a year ago

- Free cash flow: $1.95 billion vs $425 million last year

- Cash, marketable investments, and restricted cash: $12.2 billion vs $9.2 billion last year

- Diluted EPS: $1.68 vs 0.30 a year ago

Micron says its high-capacity DIMM and LP server products have generated multiple billions of dollars in revenue in fiscal 2025, fivefold growth compared to the same period last year.

It’s shipping HBM in high volume to four customers, spanning both GPU and ASIC platforms. Its yield and volume ramp on HBM3E 12-Hi is progressing well, and it sees shipment crossover from HBM3 in the current quarter. Micron expects its HBM market share to grow to the 22-23 percent level, matching its overall DRAM market share, behind Samsung (41.1 percent) and SK hynix (34.8 percent). It thinks it could achieve this in calendar 2025.

According to TrendForce, current HBM supplier market shares are SK hynix: 46-49 percent; Samsung: 42-45 percent; and Micron: 4-6 percent. Bloomberg Intelligence is guiding SK hynix at 40 percent, Samsung at 35 percent, and Micron at 23 percent by 2033.

Micron has delivered samples of HBM4 to multiple customers and expects to ramp volume production in calendar 2026. It is making progress developing its new and denser 1-gamma DRAM node with increasing yields on its current 1-beta node. The company has started qualifications for new high-performance SSD products based on its G9 (276-layer) 2 Tb QLC 3D-NAND die. And it is announcing a client SSD using the G9 QLC tech, delivering performance equivalent to TLC NAND for most consumer use cases.

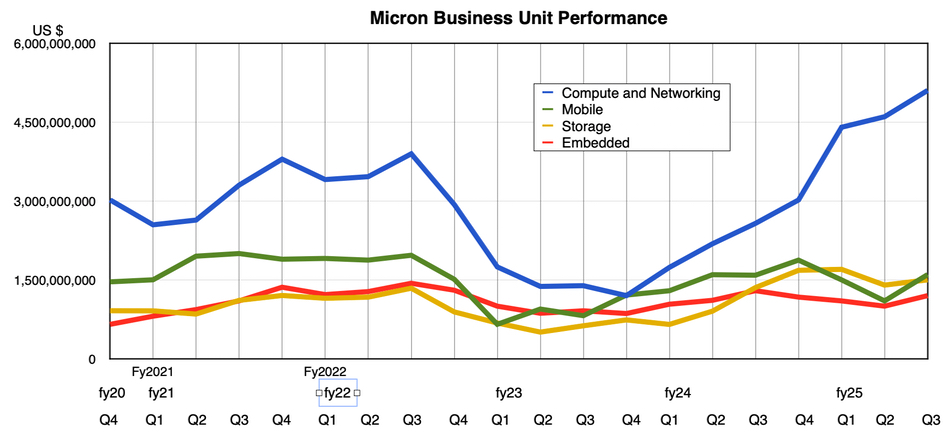

Business unit performance

- Compute and Networking: a record $5.1 billion, up 11 percent sequentially, 98 percent year-over-year.

- Storage: $1.5 billion, up 4 percent sequentially, 11 percent year-over-year, primarily from consumers buying SSDs.

- Mobile: $1.6 billion, up 45 percent sequentially, 0.8 percent year-over-year, on phone demand for DRAM.

- Embedded: $1.2 billion, up 20 percent sequentially, down 8 percent year-over-year, with growth due to recent tight supply of DDR4 and resulting improved pricing.

Micron has completed an AI-focused strategic reorganization of its business units around key market segments, such as high-performance memory and storage, to capitalize on “the tremendous AI growth opportunity ahead.”

The company is going to fab more memory in the US with plans to invest approximately $200 billion, which includes $150 billion in manufacturing and $50 billion in R&D over the next 20-plus years. As part of the $200 billion, it plans to invest an additional $30 billion beyond previously announced plans, including the construction of a second memory fab in Boise, Idaho, expanding and modernizing its existing fab in Manassas, Virginia, and bringing advanced packaging capabilities to the US to support long-term HBM growth plans.

It expects to begin ground preparation of its New York fab later this year following the completion of state and federal environmental reviews.

Micron says its customers continue to signal a constructive demand environment for the remainder of calendar 2025.

The revenue outlook for the final FY 2025 quarter is $10.7 billion ± $300 million, a 38.1 percent rise at the midpoint, and $36.7 billion revenues for the full year, 46.2 percent up on FY 2024.