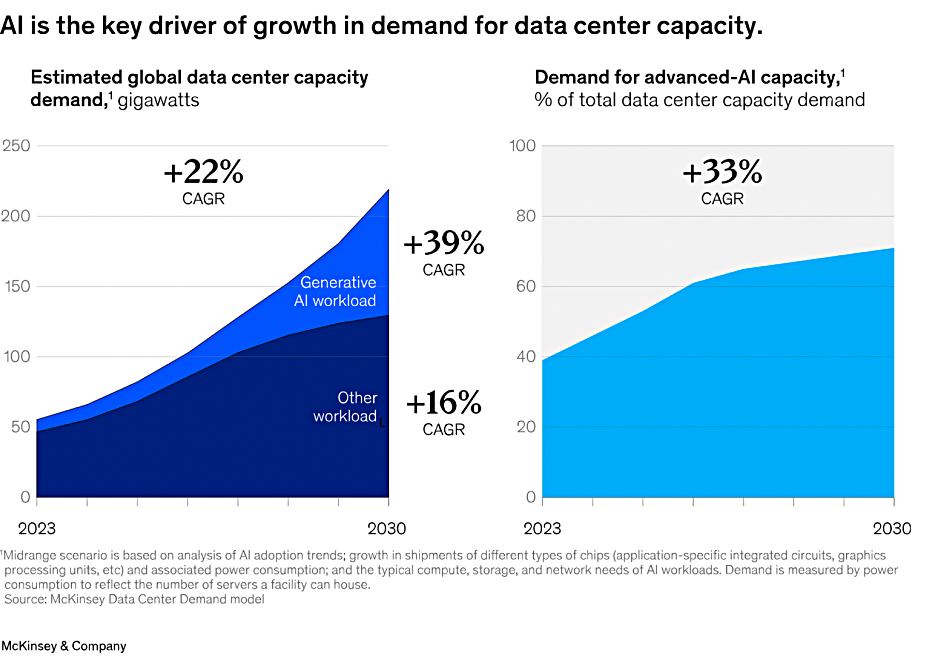

Datacenters face a period of power supply limitations that affect their growth and the growth of the IT services they will provide. Lower power-consuming IT devices will help but the GPUs needed for AI use vastly more electricity than X86 servers. Hyperscalers can build their own datacenter energy generators but the rest of us are dependent on national grids and they are slow-development systems, meaning we face a restriction on the growth of IT services for businesses and consumers as IT service demand will exceed electricity supply growth.

Datacenter growth is continuing. Research from the Dell’Oro Group shows the Data Center Physical Infrastructure (DCPI) market grew 17 percent YoY in 1Q 2025. This marks the fourth consecutive quarter of double-digit growth, fueled by continued investment from hyperscalers and colocation providers building out capacity to cope with demand of artificial intelligence (AI) workloads. It noted surging adoption of liquid cooling (DLC revenue doubled), high-density power racks nearing 600 kW, and 40 percent+ growth in power distribution systems like busways.

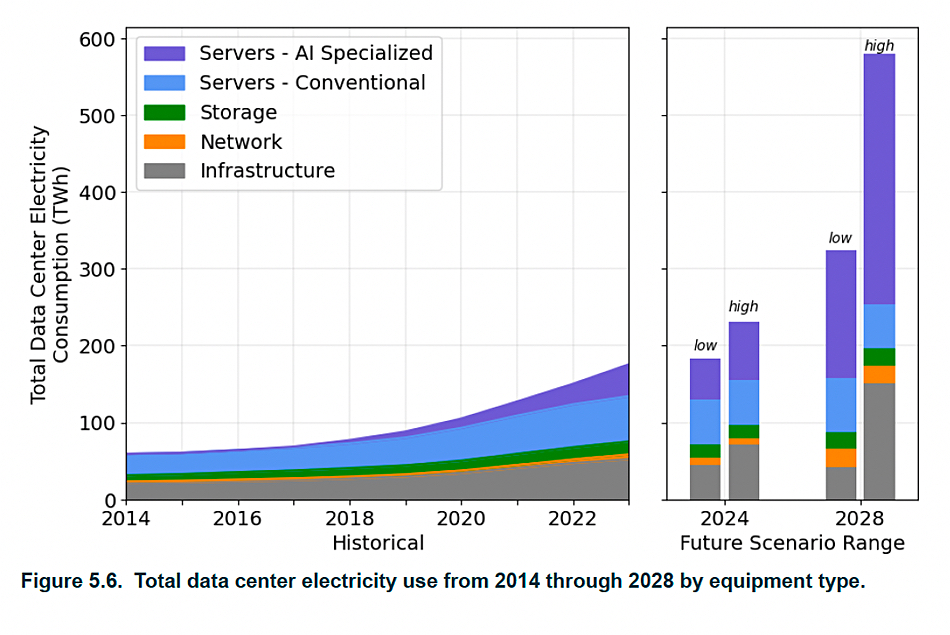

While all regions posted growth, North America outpaced the rest with a 23 percent Y/Y increase. A US DOE report found that datacenters consumed about 4.4 percent of total U.S. electricity in 2023 and are expected to consume approximately 6.7 to 12 percent of total U.S. electricity by 2028. The report indicates that total datacenter electricity usage climbed from 58 TWh in 2014 to 176 TWh in 2023 and estimates an increase between 325 to 580 TWh by 2028.

Alex Cordovil Araujo, Research Director at Dell’Oro Group, said: “The shift to accelerated computing is reshaping the datacenter landscape,” said Alex Cordovil, Research Director at Dell’Oro Group. “AI is more than a tailwind—it’s a structural force driving demand for new infrastructure paradigms. Liquid cooling is gaining traction fast, and high-density power architectures are evolving rapidly, with racks expected to reach 600 kW soon and 1 MW configurations already being under consideration.”

Its Data Center IT Capex 5-Year January 2025 Forecast Report says that worldwide datacenter capex is forecast for a CAGR of 21 percent by 2029. Accelerated servers for AI training and domain-specific workloads could represent nearly half of datacenter infrastructure spending by 2029.

The Dell’Oro Group forecasts that worldwide datacenter capex is projected to surpass $1 trillion by 2029. AI infrastructure spending will maintain its strong growth momentum despite ongoing sustainability efforts. It thinks that: “The proliferation of accelerated computing to support AI and ML workloads has emerged as a major DCPI market driver which is significantly increasing datacenter power and thermal management requirements. For example, the average rack power density today is around 15 kW/rack, but AI workloads will require 60 – 120 kW/rack to support accelerated servers in close proximity. While this jump in rack power density will trigger innovation and product development on the power distribution side, a bigger change is unfolding in thermal management – the transition from air to liquid cooling.

These new datacenters will require electricity supplies and national grid systems are becoming choke points in delivering that. Datacenters currently use about 3 percent of global electricity, and this could double by 2030, creating serious power generation and supply problems as well as environmental impact issues.

In one sense we are not constrained by energy generation, as we have oil, gas and coal-fired power stations, plus nuclear, hydro-electric, wind, and solar generation. However coal, oil and gas generation, the fossil fuel trio, harm the environment, with coal being the worst in that regard. The generation trend is to phase out coal-fired power stations, less so the oil and gas ones, with renewables, wind and solar, coming to the fore. They can both be expanded while hydro-electric generation is limited by restricted site availability. Nuclear power generation has been restricted due to radiation and nuclear fuel contamination and disposal issues but t is showing signs of a come back, with small, modular reactors playing a role. Pure International CTO Alex McMullan says the 3 largest hyperscalers consume >60TWh and all now either own (or are in the process of owning) their own nuclear power stations.

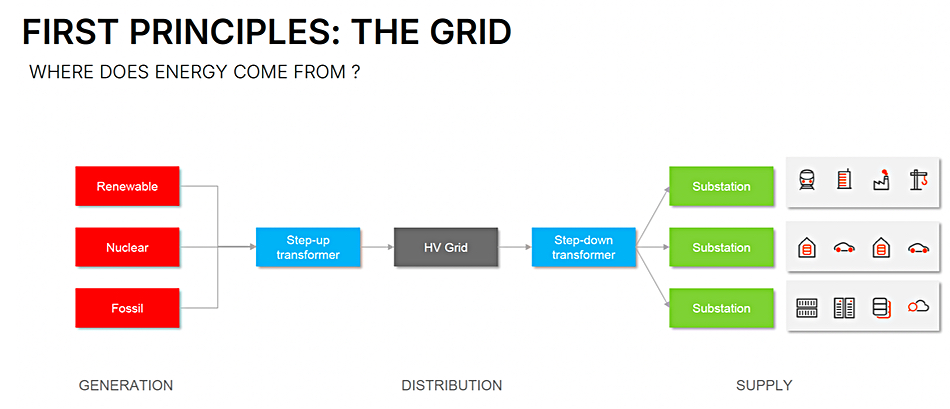

However, even if sufficient electricity can be generated, its delivery brings in fresh problems. A national grid connects power generating sites with power-consuming sites, such as datacenters. Such grids, which supply both businesses and domestic users, large and small consumers, have to maintain a balance between supply and demand. Overall demand rises in the day time and falls at night as millions of consumers follow a day:night activity profile. With renewables there can be shortfalls and over-supply because wind speeds can increase and decrease, and solar power is a day-time generation supply only.

Against this background grid operators have to balance supply and demand, switching generation on ir off, as well as generators’ connection to the grid on or off. This is not a simple operation as the 2025 Spanish power grid failure demonstrated.

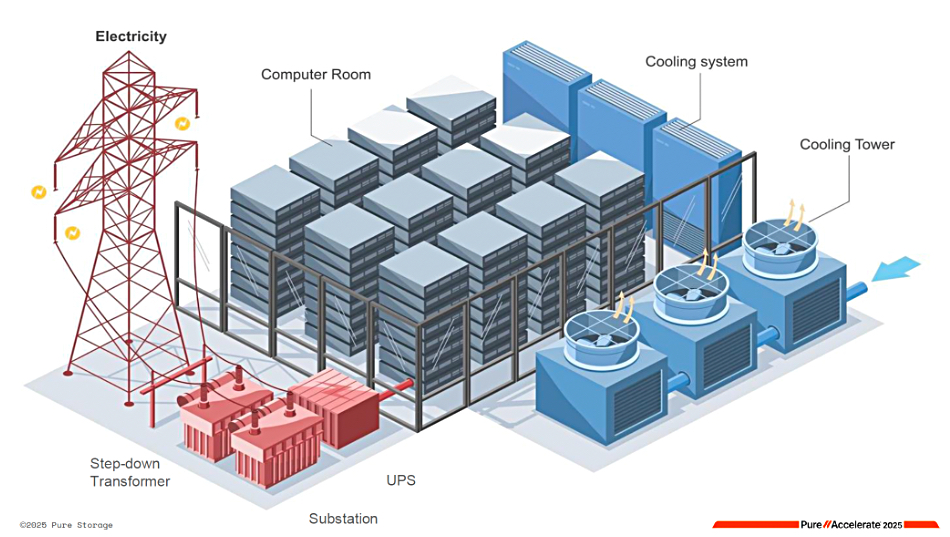

They also have to upgrade the grid wiring and switching/transforming infrastructure to cope with changes in demand over the year, new cabling built, new core and edge (substations) units constructed and deployed. McMullan says that a datacenter’s electricity requirement is growing as more and more computation is carried out by power-hungry GPUs and not relatively frugal x86 CPUs. AI is driving usage upwards.

He reckons that a GPU represents the daily energy consumption of a “standard” 4-person home at ~30kWh. NVIDIA is shipping hundreds of thousands of GPUs every quarter. A GPU represents the daily energy consumption of a “standard” 4-person home at ~30kWh. NVIDIA is shipping hundreds of thousands of GPUs every quarter. One rack of GPUs now requires >100kW which represents the output of ~200 solar panels or ~0.01 percent of the output of a nuclear reactor.

Datacenters have been measured in Power Usage Effectiveness (PUE) terms. The PUE value is calculated by dividing the datacenter’s total energy consumption by the energy used by its IT equipment. A lower PUE value indicates higher energy efficiency. It was introduced by The Green Grid (TGG) in 2007 and is a widely recognized in the industry and by governments. However it does not reflect local climate differences; datacenters in cold climates need less cooling.

Green considerations

The datacenter electricity supply issue is often viewed as part of a wider concern, which is carbon emissions. Datacenter operators, like most of us, want to reduce carbon emissions to mitigate global warming. They may also want to have more generally sustainable operations and that can mean lowering water consumption in equipment cooling.

Switching to renewable energy supply can reduce carbon emissions. Switching to air-cooling and away from water-cooling will lower water consumption and can lower electricity usage, as fans and heat sinks use less power than pumps, radiator fans and water reservoirs. But water-cooling can handler higher heat loads, so it may be needed for GPU servers. Also, datacenters in equatorial regions will find air-cooling less effective than datacenters in temperate and cold regions.

We can’t locate datacenters just for cooling efficiency as they may be thousands of miles away from users with excess data access times due to network transit times. They also need to be not too far from electricity generating sources as a percentage of generated electricity is lost due to grid transit and step-up, step-down transformer operations.

Optimising for datacenter cost, IT equipment performance, user data access time, datacenter electricity supply and demand, and water consumption, is a complicated exercise

Datacenter electricity usage

A datacenter’s power budget is fixed; its grid power supply and edge connectivity devices are hardware and so have impassable upper bounds. If one portion of its internal infrastructure takes up more power, such as a switch from CPUs to GPUs, then there is less power available for other things. Power efficiency is becoming a key consideration

It’s been estimated that 26 percent of datacenter electricity supply is used by servers (20 percent) and storage (6 percent), with the rest being consumed by cooling and UPS’ (50 percent), power conversion (11 percent), network hardware (10 percent) and lighting (3 percent). These are approximate numbers as datacenters obviously vary in size and in cooling needs; datacenters in cold climates need less cooling.

Operators can look at individual equipment classes to reduce their power consumption with cooling and UPS power efficiency a key concern, as it is responsible for half the electricity needed by an average datacenter. Servers, storage and networking devices can also be optimized to use less power. For example, Pure Storage DirectFlash technology lowers NAND storage electricity needs by compared to off-the-shelf SSDs.

It’s not just datacenters that are the issue. To decarbonize economies countries need to move manufacturing, food production and industrial activities away from fossil fuel-powered energy generation. They will need to adopt electric vehicles, and that alone could require an up to 100x increase in power generation.

The whole electricity supply chain, from mining copper for cables, aluminium and steel for power generation and transmission equipment, power generation itself, building the end-to-end grid infrastructure, managing its operation better, developing more resilience and supplying large users more effectively, needs updating. This is going to be multi-billion if not trillion dollar project.

National governments need to become aware of the issue and enable their power generating and supply organizations to respond to it. IT suppliers can do their part by lobbying national and state policymakers but, fundamentally, a country’s entire business sector needs to be involved in this effort.