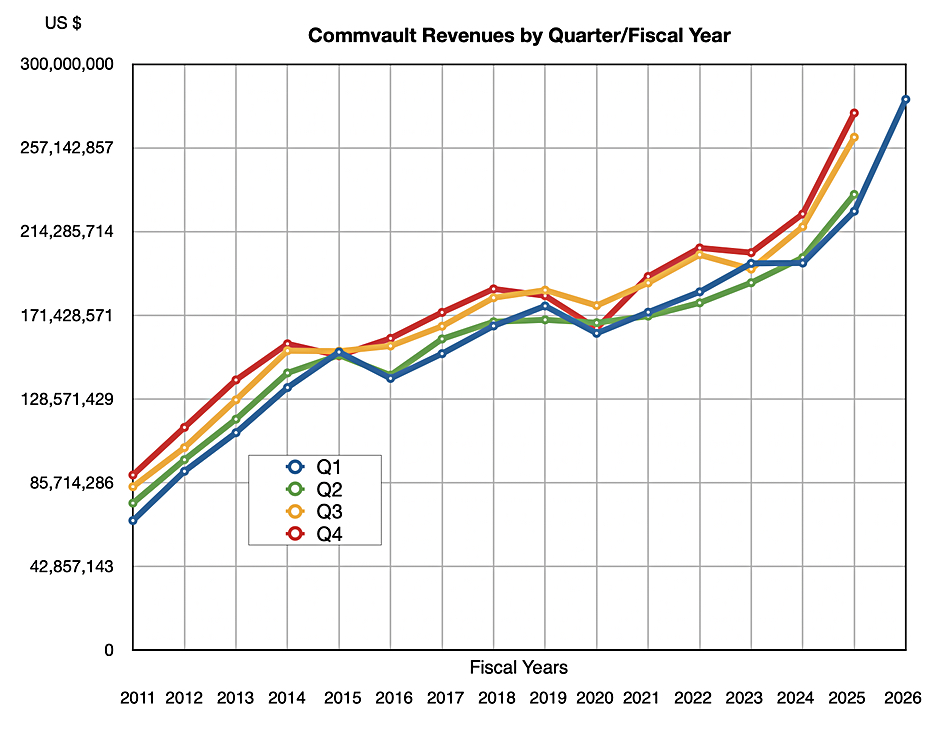

Commvault beat expectations again in its latest quarter, growing revenue 26 percent year-over-year to $282 million and surpassing guidance across all key metrics, with a GAAP profit of $23 million, up 24 percent year-over-year.

Total annual recurring revenue (ARR) was up 24 percent to $996 million, just shy of the billion-dollar mark. SaaS ARR was up a substantial 63.2 percent to $306.9 million as the Metallic SaaS backup offering became more popular, passing 8,000 customers. The total subscription count reached 12,900, up 30 percent year-over-year.

President and CEO Sanjay Mirchandani said: “Our execution has never been better across the business. We continue to see hyper-growth with our SaaS platform. SaaS ARR soared 63 percent to $307 million, and in Q1, we surpassed 8,000 customers. And we’re set to surpass our $330 million ARR target well ahead of schedule.”

“Those [SaaS] stats also speak to our overall land and expand business. In fact, in Q1, across software and SaaS, we had our best land and expand quarter ever.”

Commvault is surging ahead, with Mirchandani saying: “We’re seeing tremendous success in emerging routes-to-market, including cloud marketplaces. During the quarter, we achieved triple-digit growth in marketplace transactions, with multiple six-figure and seven-figure deals… In terms of execution, we posted healthy growth across geographies, industries, and customer segments – from Enterprise to SMB.”

Financial summary:

- Gross margin: 82.3 percent vs 82 percent a year ago.

- Operating cash flow: $32 million

- Free cash flow: $30 million

- Cash and cash equivalents: $363 million

Mirchandani identified three big drivers for the business: cyber-resiliency where the “market is booming,” partner ecosystem breadth with recent additions CrowdStrike, Deloitte, HPE, and Kyndryl, and product innovations such as the pending acquisition of Satori Cyber. CFO Jennifer DiRico said “The transaction will be funded from our international cash balance,” so it’s a cash purchase. DiRico said: “We ended Q1 with no debt and a cash position of $363 million.”

Cyber-resiliency is a huge and growing market. Cybersecurity Ventures research says ransomware costs will reach $57 billion this year and $275 billion by 2031. This forecast and the Commvault numbers suggest other cyber-resiliency/data protection vendors like Cohesity, Rubrik, and Veeam should do well too.

Wiliam Blair analyst Jason Ader told subscribers: “The stock is up over 18.5 percent following the healthy first-quarter results as investors see the fruits of Commvault’s labor in the numbers and clear evidence of the company’s formidable position in the crowded data protection landscape.”

Looking ahead, Mirchandani said: “With a best-in-class partner ecosystem and continuous innovation that we believe sets us apart, we are well positioned to continue to take share in fiscal 2026 and beyond.”

The revenue forecast for the next quarter is $273 million ± $1 million, up 17 percent at the midpoint, and full FY 2026 revenue guidance has been increased from $1.135 billion ± $5 million to $1.163 billion ± $2 million, up 16.8 percent at the midpoint.