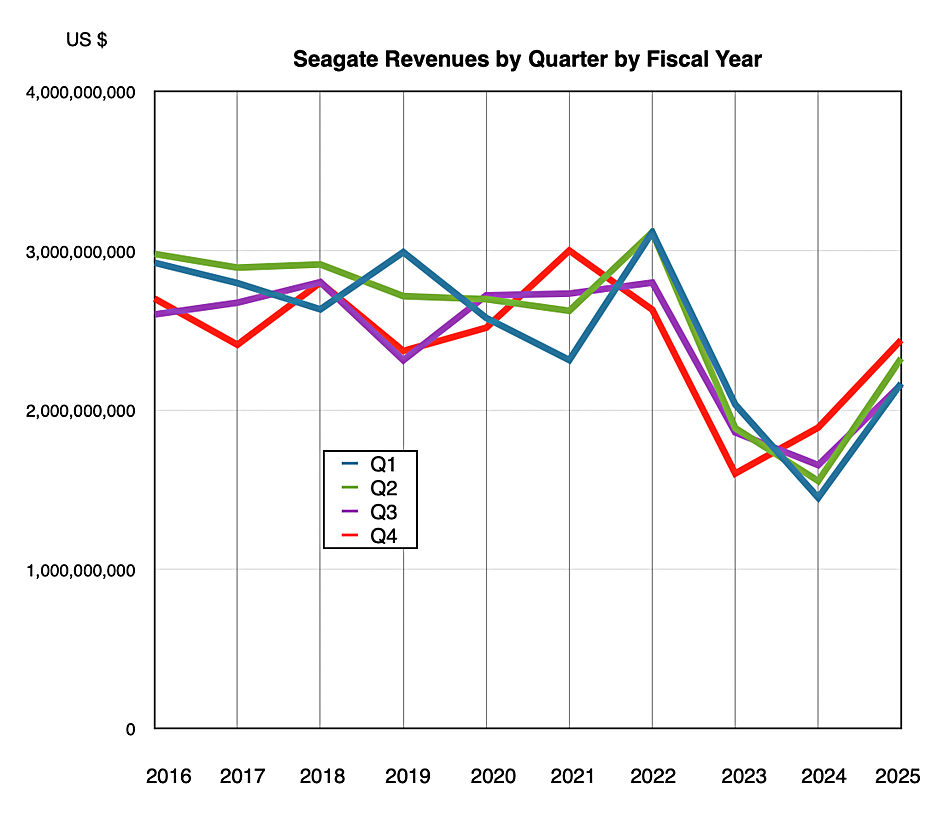

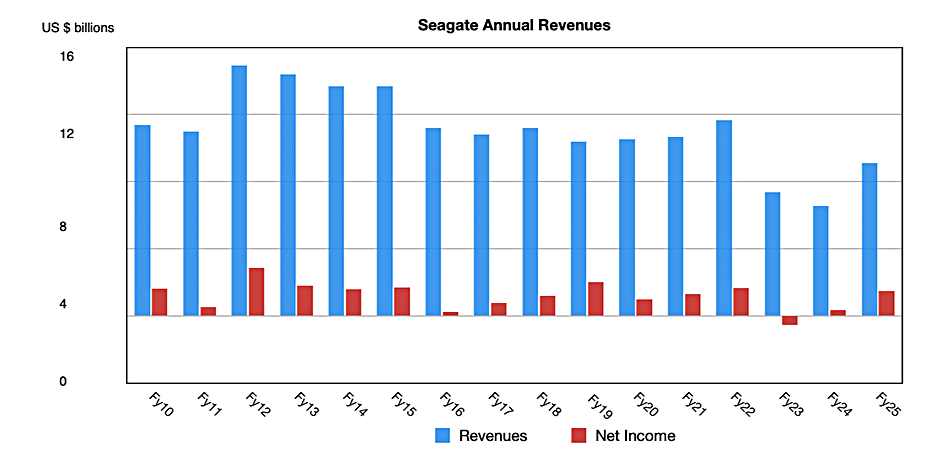

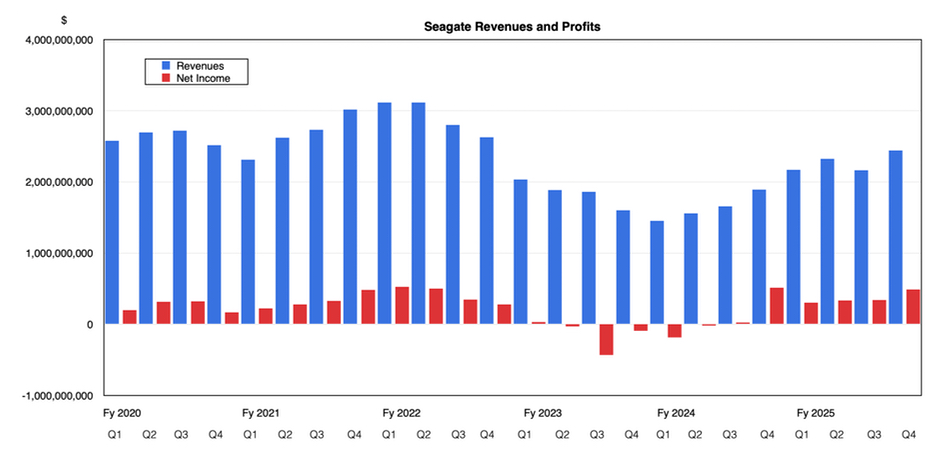

Seagate revenues grew by almost 39 percent year-on-year in the corporation’s fiscal 2025 ended June 27 as HAMR drives lifted it out of a two-year sales slump. The drive maker reported full-year turnover of $9.1 billion and net profit shot up to $1.47 billion from just $335 million in 2024.

Finishing the year on a high, Seagate recorded a near-30 percent year-on-year rise in Q4 revenues to $2.44 billion, within its guidance range, but net profits shrank 4.9 percent to $488 million.

CEO Dave Mosley said in a statement: “Seagate closed out fiscal ‘25 delivering strong financial results for the June quarter, marked by 30 percent year over year revenue growth and record gross margins, which improved for a ninth consecutive quarter – a trend that is set to continue as HAMR adoption gains momentum.”

Seagate’s board is making Mosley chairman after an eight-year reign. The previous chairman, Mike Cannon, is becoming lead independent director.

Financial Summary

- Gross margin: 37.9 percent vs 35.2 percent in prior quarter

- Operating cash flow: $508 million vs $259 million in Q3

- Free cash flow: $425 million vs $216 million in Q3

- Cash and cash equivalents: $2.2 billion, up 9 percent sequentially

- Gross debt: c$5 billion vs $5.1 billion in Q3

- Diluted EPS: $2.59

Seagate’s nearline (mass-capacity) drive revenues were $2 billion in Q4, up 40 percent and providing 88 percent of its overall HDD revenue, $2.28 billion. The company is becoming a single-segment supplier, and shipped 136.6 EB of nearline capacity, up 52 percent, compared to 11.5 EB of other, legacy HDD capacity, up 12 percent year-over-year.

There were record quarterly sales and volume shipments of its non-HAMR 24 TB conventional and 28 TB Shingled disk drives and these provided the majority of its revenues.

Although Seagate is currently doing well, its annual revenues are still well below its 2012 peak of $14.9 billion. The company has consistently failed to match that revenue level in the intervening years as SSDs have killed its enterprise high-performance disk, laptop, PC, and workstation disk drive sales.

It found a consistently growing market in enterprise and hyperscale mass-capacity, nearline drives, where its HAMR tech has given it a capacity advantage over main rival Western Digital. Seagate is now sampling its fourth generation HAMR tech drives, with 44 TB capacities in prospect.

Mosley said: “We are confident in our ability to produce compelling growth in revenue, profitability and cash generation in fiscal ‘26 and beyond.”

This HAMR tech has been in development since 2002, with prolonged and difficult technology and manufacturing process development efforts, culminating in extended sampling and evaluation testing by hyperscale customers. Only now has this enabled Seagate to make 28 and 30 TB Exos M datacenter and IronWolf Pro NAS HAMR drives generally available.

There are three major cloud service providers (CSP) that have qualified HAMR, but this process is not complete, with Mosley saying: “We are tracking to plan with shipments expanding to additional CSPs in the September quarter. Across the board, qualifications are progressing exceedingly well, and we continue to expect the key global CSP customers to be qualified by mid-calendar 2026.”

Seagate has started sampling Mozaic 4+ 4 TB/platter Gen 4 HAMR drives and expects “to begin volume ramp in the first half of calendar 2026. This timeline is consistent with our target for exabyte shipment crossover on HAMR-based nearline drives in the second half of calendar ’26” versus non-HAMR drives.

Mosley teased fifth generation 5 TB/platter HAMR technology, mentioning granular iron platinum media and photonics: “We continue to make steady progress with 5 TB per disk technology aligning to our goal of introducing it into the market in early calendar 2028, a time frame when we also expect to demonstrate double that capacity – 10 terabytes per disk – in the lab.”

He called out two AI-related prospective market developments. “Today roughly 50 percent of the world’s data centers are concentrated in just 4 countries. As data sovereignty regulations evolve and proliferate around the globe we expect a growing demand for localized data storage. In this context, mass capacity hard drives will be critical from a footprint, efficiency and TCO perspective insuring data is safe, secure and compliant.

“For datacenters at the edge, we expect enterprise storage demand will mirror the trends we’ve seen in the cloud, where upfront AI infrastructure investments led to increased demand for mass data storage over time.”

CFO Gianluca Romano said during the earnings call that video storage was becoming important for AI in the cloud and that’s needed at the edge as well. “You’re starting to see all kinds of different applications, whether they’re video applications themselves, factories, safety, factory efficiency, hospitals. There’s a lot of big data sets that exist, especially video data sets that exist at the edge.”

He said edge data storage was changing. “Interestingly, at the edge, we’re starting to cross over from a point where you maybe treated data as something that you had to sort through and then delete. Now it’s just snapshot, snapshot; just keep saving lots of snapshots at the edge because you might want to go back and look through it. So those are actually driving some of the edge growth.”

Mosley added: “There’s a lot of data at the edge that ultimately gets just thrown away. And so, if it could be processed or stored longer, it’s more interesting to us.”

Seagate is changing its revenue segment reporting. Romano said: “Starting in the September quarter, we plan to adjust how we discuss our end markets. We will focus on two main areas: datacenter and edge/IoT. The datacenter markets accounted for about 75 percent of our fiscal 2025 revenue and include nearline products and systems sold into cloud and enterprise customers, as well as cloud-based VIA applications. Edge/IoT includes consumer and client-centric markets, along with network attached storage. We believe this new framework is better aligned with industry practice and reflects the AI-driven market we serve today.”

The company is in better health. SSD cannibalization has stalled in the nearline HDD market as the price of QLC SSDs is still five to six times higher at the TB level and shows no signs of falling from that premium. The main capacity increase avenue for SSD makers is to up the 3D NAND layer count, but each upward generational shift costs more to develop and manufacture. The NAND manufacturers have said the layer count race is over and their main concern is profitability, not building more fabs to expand further into the HDD market.

Next quarter’s revenue outlook for Seagate is $2.5 billion ± $150 million, a 15 percent year-over-year increase at the midpoint. That’s half the increase this quarter. Seagate shares dropped 8 percent from $154.75 in extended overnight trading.