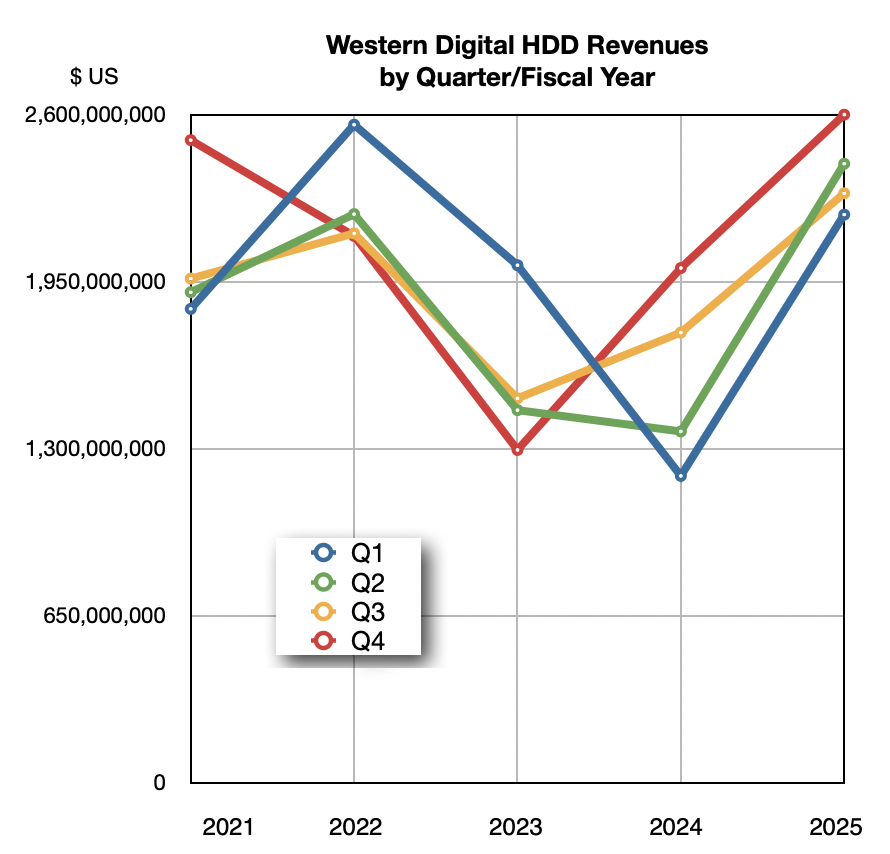

Western Digital posted a strong set of fourth quarter financial results as cloud and datacenter customers accounted for 90 percent of its revenue, underscoring its increasing reliance on a single nearline HDD product line.

Revenues for the three months ended June 27 were $2.61 billion, a 30 percent year-on-year uplift, and net income was $282 million versus $39 million. Full fiscal 2025 revenues were $9.52 billion, up 51 percent year-on-year and beating its guidance, and net profit of $1.9 billion, compared to a $33 million loss in fiscal 2024.

CEO Irving Tan stated: “Western Digital executed well in its fiscal fourth quarter, achieving revenue and gross margin above the high end of our guidance range while delivering strong free cash flow. In addition, during the quarter, we reduced debt by $2.6 billion, initiated a cash dividend, and announced the authorization of a $2 billion share repurchase program, reflecting our confidence in the long-term cash generating capability of our business.”

Western Digital has appointed a new CFO, Kris Sennesael, to replace the departed Wissam Jabre, who left in January to join NetApp.

Financial summary:

- Gross margin: 41.0 percent

- Operating cash flow: $746 million

- Free cash flow: $675 million

- Cash and cash equivalents: $2.1 billion

- Diluted EPS: $0.67

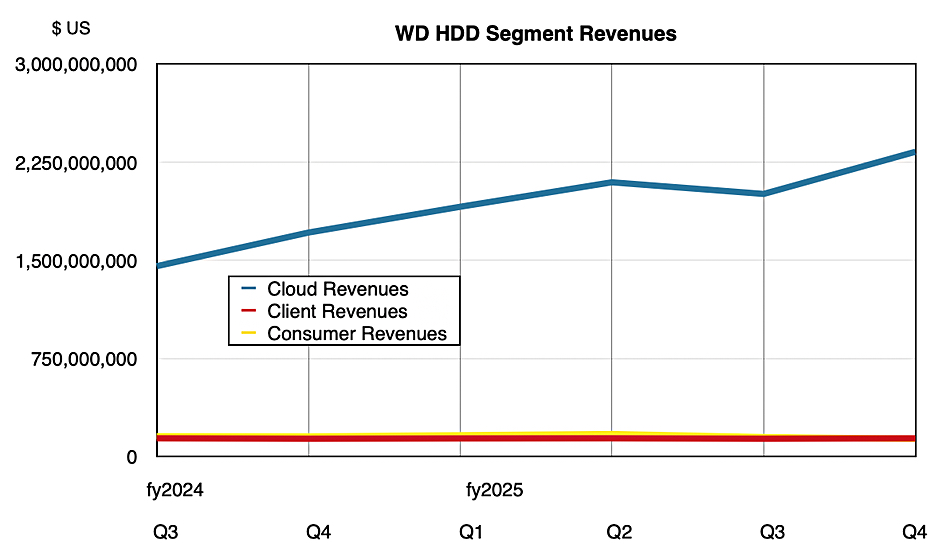

Cloud (datacenter), storing data on high-capacity, nearline disk drives, is WD’s largest market, providing $2.33 billion of its revenues, up 36 percent, with consumer ($136 million, up 2 percent) and client ($140 million, down 12 percent) markets each contributing roughly 5 percent.

Western Digital shipped 12.9 million HDD units, up from 12.1 million a year ago. There were 9.3 million nearline drives, compared to 7.9 million a year ago, 2.1 million client units versus 2.3 million, and 1.5 million consumer drives versus 1.9 million.

It shipped 190 EB of capacity, 170 EB of which was nearline. Most of the nearline drives are bought by WD’s top 5 customers who are hyperscalers. Two of them are using UltraSMR drives, a third has completed qualification and a fourth is currently qualifying the drives.

The non-nearline shipped capacity number has been decreasing quarter by quarter with the quarterly values from the start of this fiscal year being 24 EB, 22 EB, 21 EB, and, in the latest quarter, just 20 EB.

CFO Sennesael said in the earnings call: “We delivered 190 exabytes to our customers, up 32 percent year-over-year driven by strong nearline shipments and the ramp of our 26 TB CMR and 32 TB UltraSMR drives.” Western Digital has a further ePMR drive generation – 28 TB CMR, 36 TB UltraSMR – in development.

Tan said: “It’s very important to note that UltraSMR is a technology that will be extensible into HAMR as well. As we transition into our HAMR products in the not-too-distant future, we will be able to deliver that on the UltraSMR platforms as well to enable our customers to take advantage of the incremental capacity points within that.”

“We will start qualification of HAMR in the second half of calendar year ’27 with ramp in the first half of ’28 … That will be at the 38 terabytes CMR, 44 terabyte UltraSMR. As we’ve highlighted in the past, we feel the 4 TB per platter … is sort of where we see … the economic crossover where it makes economic sense to transition to HAMR.”

On AI, he said: “AI is ushering in the new era of data growth by fundamentally transforming how data is created, collected, processed and stored and more importantly, valued. Looking beyond large language models, which have been a key driver of storage needs, the emergence of Agentic AI at scale in multiple industries is creating an increasing need to store unstructured data. Agents customized with domain-specific knowledge will create a significant amount of distinct use cases, and generate data at an unprecedented pace.”

“Within our own engineering organization, we are already realizing tangible benefits of Agentic AI to help accelerate our product development cycles.”

“As data becomes more valuable and central to AI-driven innovation, the need to store and retain it at scale grows in parallel. And no storage technology matches the cost efficiency and reliability of HDDs, which remain the foundation of the world’s data infrastructure, delivering unmatched value for mass storage in an AI-driven future.”

Tan now thinks that AI could drive the market demand for exabytes up from WD’s previous 15 percent annual increase to somewhere between 15 and 23 percent.

Western Digital ships ePMR (energy-assisted perpendicular magnetic recording) disk drives with HAMR representing the next technology generation, which is needed to drive areal density higher. Tan said: “Our next generation of ePMR drives will complete qualification in the first half of calendar year 2026. These drives will continue to deliver strong TCO along with the hallmark reliability and predictability, paving the way for a smooth and economically sound transition to HAMR.”

WD is having its HAMR development drives evaluated by customers, with Tan saying: “The feedback from tests at two of our hyperscale customers continues to be encouraging. I am pleased to note that we are ahead of our internal milestones with steady progress in areal density improvement and continue to focus on increasing long-term reliability and manufacturing yield of our HAMR products.” It has to transition from testing to qualification at these customers. He expects to see “a ramp in the first half of calendar year 2027.”

Meeting market demand for HDD exabytes can be achieved by increasing capacity per drive at a high enough rate so as not to need building extra plants to make more drives, WD thinks.

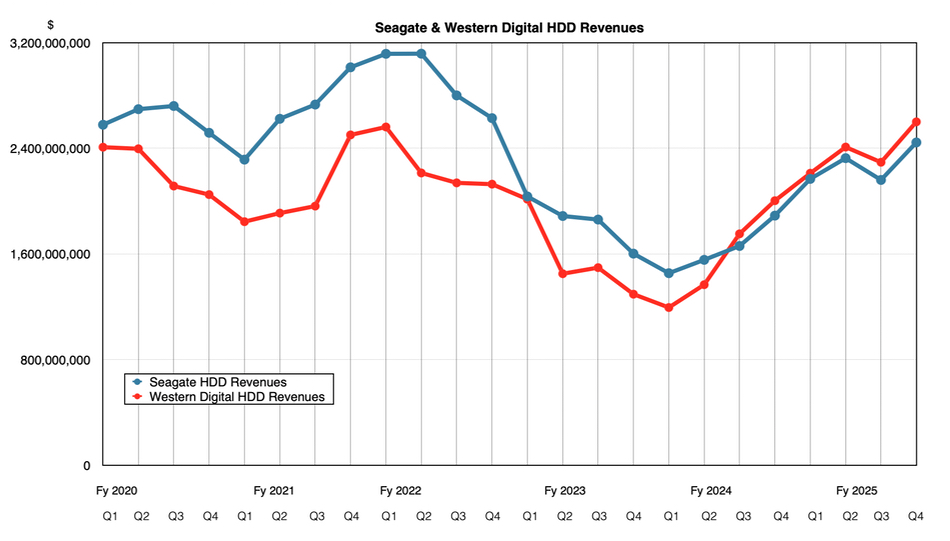

The company has 6.8 percent larger revenues than Seagate, which has an opportunity to draw ahead of WD if its HAMR disks sell better than WD’s ePMR drives.

WD says that it has long-term agreements (LTAs) with all of its top five hyperscale customers covering fiscal 2026. This gives it a good idea of future sales and for the next (Q1 FY 2026) quarter, it expects continued revenue growth driven by datacenter demand.

The outlook for the next quarter is $2.7 billion ± $100 million in revenues, 22 percent higher than a year ago at the midpoint.

As for SSD cannibalization, Tan said: “We are confident that HDDs will continue to remain the foundation of the world’s data infrastructure, delivering unmatched value for mass storage in an AI-driven future.”

With Seagate forecasting $2.5 billion revenues for the next quarter, it is not anticipating taking a lead over WD in the HDD market.

Bootnote

The year to 18-month LTAs reflect the hyperscale customer’s recognition that high-cap HDDs take a long time to manufacture. Tan said it takes “roughly nine months to produce a head wafer and then three months to convert them into headstack. So one year lead time on that component alone.”